Inside the GameStop Saga: A Lesson in Narrative Attacks and Market Manipulation

How the meme stock frenzy caused financial and reputational harm to GameStop, Robinhood, and retail investors.

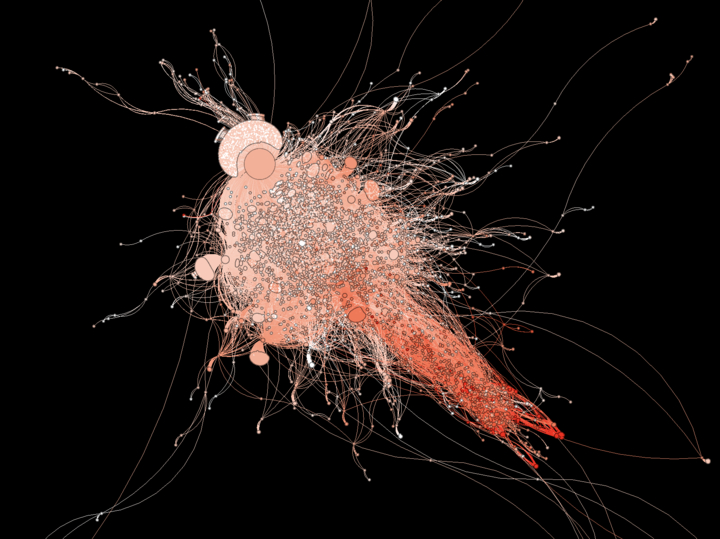

Image: Dall-E 3

In January 2021, a group of individual retail investors on the WallStreetBets chat forum organized an extensive buying campaign of GameStop stock (ticker: $GME), causing stock prices to soar. Within days of this campaign, the $GME stock price hit a pre-market high of over $500, costing hedge funds an estimated $19.75 billion yearly.

On January 28th, 2021, several retail investment brokers restricted trading of certain stocks, including GameStop. Before these events, Robinhood was known for making it easy for retail investors to buy and trade stocks. However, these restrictions only allowed users to sell their positions, restricting the purchase of the store.

The sudden shutdown sparked outrage among its users and on social media, leading to a surge of conspiracies that cluttered the information environment. The new film Dumb Money is a powerful example of how narrative attacks can cause financial and reputational harm to financial institutions.

LEARN MORE: What Is A Narrative Attack?

Updated: GameStop Influencers Give New Life To Old Memes

When we first published research in November 2023 GameStop and memestock and narrative attack had settled at a low simmer after circulating online for years. But the narratives hit full boil again last month after many of the original influencers began sharing much of the original content.

For example, a user known as Roaring Kitty, notorious for leading the 2021 GameStop surge, shocked the community in May 2024 after posting on social media for the first time in three years. Roaring Kitty subsequently posted screenshots of his GameStop holdings. Following these posts, GameStop stock soared, signifying the beginning of another frenzy. Narratives circulating around the current memestock frenzy share common threads with the conversation in 2021. Narratives previously questioned the market’s integrity and shared allegations suggesting that the market might be structured to benefit a select few rather than the average person, leading to accusations of corruption, manipulation, or fraud. These concepts are the backbone of the 2024 memestock conversation.

As GME stock prices soared, trading was purportedly halted numerous times, sparking outrage across social media. Narratives formed claiming the market is a scam and corrupt, similar to “The Free Market is not so Free.” Likewise, the month following Roaring Kitty’s GameStop holding reveal, reports surfaced alleging E-trade and the SEC are concerned about possible market manipulation by Roaring Kitty. Amid these allegations, fans grew angry and claimed hypocrisy. They asserted that Congress does the same thing yet never faces the same backlash, maintaining that the market is not for the regular person, similar to “The Wrong People Profited.”

These parallels demonstrate how tracking narratives can serve as a future predictor and underscore the need for organizations and governments to monitor and address harmful narratives proactively.

Here are the top narratives our analysts identified using Blackbird.AI’s Constellation Narrative Intelligence Platform:

Narrative 1: The Free Market is not so Free

Following Robinhood’s decision to restrict trading, conversation erupted with users questioning and simultaneously mocking the term ‘free market.’ This narrative did not just target Robinhood but transcended into the discussion of the general marketplace and the establishment itself, attracting 151,750 engagements from 3,633 posts. Many called the ‘free market’ a scam because the ordinary trader would not be halted after large profits if the market were free. In addition, many claimed that restrictive trading disenfranchises the establishment of a free market and goes against what the country was founded upon. Many users indicated they had lost trust in the institution, stating the “’free market’ isn’t so free after all.”

Narrative 2: The Wrong People Profited

Many users stated that restrictions were imposed because the wrong people profited. In other words, ‘ordinary people’ were benefiting, not the billionaire class as they defined it. They drew comparisons, stating there would be no issue if billionaires were responsible for the short squeeze. However, because it was retail investors, they were being met with restrictions. Users cited that they were not being protected, but rather the rich were. Additionally, this narrative prompted anger across social media, garnering over 3 million engagements as anti-elitist rhetoric spread with phrases like “Eat the Rich” circulated.

Narrative 3: Hold the Line

The Hold the Line narrative erupted primarily from users participating in the short squeeze and supporters of the retail investors in efforts to encourage the continuance of holding $GME stock despite restrictions being imposed. This narrative received an influx of attention, with 1,137 posts generating 42,553 engagements. This contained high levels of abnormal activity, indicating there was likely a concerted effort to propagate the tagline “Hold the Line.” Additionally, much of this narrative contained negative sentiment targeted at the financial institutions that decided to restrict trading.

Narrative 4: Institutions Do Not Deserve a Bailout

Financial Institutions and hedge funds lost billions in the GameStop short squeeze. Many users speculated that these businesses would require a bailout. However, this was met with opposition as many social media users mocked the idea that these institutions would receive bailouts, with some citing stimulus checks and the ongoing pandemic, saying, “They are going to bail out the billionaires and not even give us stimulus checks.” This narrative attracted large negative sentiment (22.2%) as users openly showed disdain for large companies. This narrative also drew extensive engagement, garnering 524,473 engagements from 1,618 posts.

Narrative 5: Robinhood Manipulated the Market

Amid Robinhood’s action to restrict users from buying certain stocks, a narrative formed where users began calling this action a market manipulation whereby 2,018 authors received 137,823 engagements. Users believed that disallowing users to participate in the buying and selling of shares was a market manipulation. Some went further with conspiracy claims, such as the hedge fund Citadel, which owned Melvin Capital Management. This company was a short seller of $GME and was poised to lose millions. It also held the Robinhood app and decided to restrict users. This narrative spread, prompting claims that they purposefully manipulated the market to protect their interests.

Harmful narratives circulated in response to the Robinhood platform imposing restrictions on users’ ability to buy and sell. These actions brought on a myriad of negative sentiments as social media users perceived these actions as an attack on the everyday person. Robinhood, a trusted platform for trading for retail investors, faced loss of trust from customers who no longer trusted the platform and faced reputational damage as narratives circulated across social media.

Gartner predicts that by 2028, enterprise spending on combating narrative attacks and malinformation will surpass $500 billion, consuming 10% of marketing and cybersecurity budgets to counter this multi-front threat.

To learn more about how Blackbird.AI can help in these situations, contact us here.

Need help protecting your organization?

Book a demo today to learn more about Blackbird.AI.