How a Coordinated Narrative Attack Shook U.S. Banking Trust

In early April, the viral tag #TheBanksAreOutOfMoney triggered real fears about U.S. banks and exposed how fast narrative attacks can erode public trust and destabilize critical institutions online.

Image: Dall-E 3, Blackbird.AI

In early April 2025, a hashtag claiming U.S. banks were running out of money surged across social media. The campaign appeared satirical at first, but it quickly mutated into a fast-moving, coordinated narrative attack that spooked the public and triggered legitimate fears about the health of the U.S. financial system. In a digital ecosystem built for speed, panic spreads faster than facts.

READ: Blackbird.AI’s Banking Narrative Intelligence Report

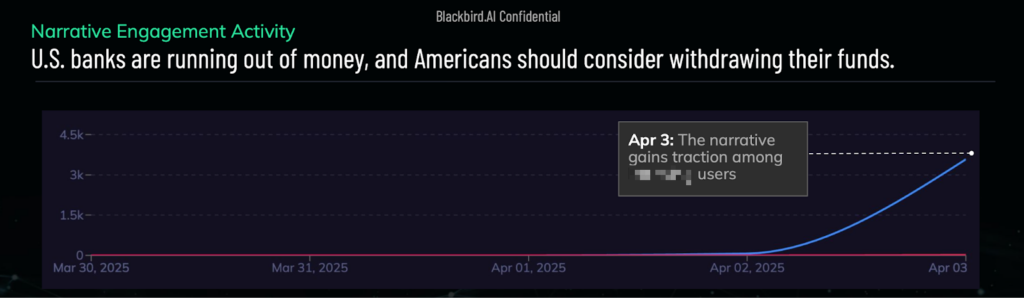

Following the announcement of new U.S. tariffs, millions of posts using the hashtag #TheBanksAreOutOfMoney urged users to withdraw money immediately. The narrative gained traction across a broad spectrum of polarized communities, partly fueled by bots and burner accounts. While many posts leaned on satire, the underlying message escalated fears, revealing how quickly a narrative attack can destabilize public trust in critical institutions.

The Narrative Origin: Satire, Panic, or Something More?

The hashtag didn’t begin with mainstream media, nor was it organically viral in the traditional sense. Instead, it was seeded on social media by a handful of pseudonymous users, notably an account named @REDACTED, who posted the hashtag multiple times between March 10 and April 1, 2025. While early posts drew modest engagement, one post just after the April 2 announcement of sweeping U.S. tariffs spiked in visibility and was among the first to prompt serious concern.

The posts often included unverified screenshots of banking app error messages, referencing well-known institutions like Bank of America and Wells Fargo. These images were frequently stripped of context and shared with calls to “get your money out now.” Many posts used humor and satire, but the messaging was cohesive enough to spark doubt, which is combustible in a crisis.

Network Amplification and Bot Behavior

The hashtag campaign bore all the hallmarks of a coordinated narrative attack. Accounts that helped spread the narrative often shared similar attributes: non-attributable burner accounts, repetitive meme-style content, and overlapping hashtags like #panic and #freakout. Bots and bot-like accounts were significantly involved in amplifying the hashtag, particularly among left-leaning social media clusters.

According to Blackbird.AI’s analysis, 17.2% of the accounts involved in the conversation displayed bot-like behavior, and a notable portion of high-engagement nodes were synthetic or pseudonymous. These patterns suggest that the campaign wasn’t just spontaneous internet noise but engineered to provoke a response.

A Cross-Partisan Flashpoint

While the initial momentum came from accounts that could be loosely classified as left-leaning, the narrative soon took on a partisan tone across ideological lines. Some users on the left echoed the message with urgency, blaming newly imposed tariffs and speculating about economic collapse. Others on the right framed the hashtag as a politically motivated narrative attack aimed at discrediting the president.

Left-leaning bots and influencers—such as @REDACTED and the now-deleted @REDACTED—were among the most active promoters of the message. In contrast, right-wing users often engaged by debunking the claims or suggesting that the campaign was a foreign information operation, possibly linked to “Russian trolls.” Both sides, however, contributed to the amplification, whether through agreement or outrage.

Visualizing the Narrative Attack

A network graph created by Blackbird.AI analysts illustrated the structural anatomy of the narrative’s spread. Nodes representing burner accounts, primarily pseudonymous influencers, were tightly clustered and hyperactive. These accounts served as central drivers, pushing the hashtag outward to broader audiences.

The most influential clusters were left-leaning users and bots, accounting for 22% of the cohort. These were responsible for a disproportionate share of engagements and shares. Meanwhile, right-wing users (7.5% of the total) formed a smaller but vocal group focused on recontextualizing the narrative as politically motivated or legally dubious.

Although bot-like activity was moderate overall, the narrative attack benefited from a network effect. Even modest automation—when coordinated and timed—can significantly distort public perception.

Narrative Risk Signals and Sentiment Trends

The narrative’s risk profile was shaped by engagement volume and sentiment and anomalies in user behavior. Blackbird.AI’s metrics flagged this campaign for high levels of coordinated activity and narrative manipulation, with moderate negative sentiment (17.5% of posts) and moderate bot engagement.

The campaign’s sentiment arc tracked with key real-world events. Engagement surged following the tariff announcement and peaked when users shared personal anecdotes, screenshots, and warnings. On April 3, a post by @REDACTED—one of the most engaged accounts in the dataset—called for people to withdraw their funds “while they still can.” The comment was widely circulated by both real users and bots, further fueling speculation and fear.

Why This Matters: Erosion of Financial Trust at Scale

A single hashtag campaign shouldn’t be able to shake public trust in the financial system. And yet, #TheBanksAreOutOfMoney shows how brittle trust can be when subjected to well-timed and well-targeted narrative attacks. Even if a narrative starts with satire or misinformation, it can take on a dangerous life once it’s stripped of context and mass-amplified.

The campaign sought to manipulate perception and incite behavior through bank withdrawals, stock selloffs, and political blame games. In this case, no systemic financial crisis occurred, but the infrastructure to spark one—at least in perception—is already in place.

These attacks don’t need to be true. They just need to be believed long enough to cause disruption.

The Way Forward: Five Takeaways for Organization Leaders

The #TheBanksAreOutOfMoney narrative wasn’t just a punchline turned panic. It was a case study in how modern manipulated narratives can leap from the fringe to the mainstream in hours, not days. For leaders tasked with protecting brands, institutions, and the public from destabilizing narrative campaigns, here are five critical lessons:

Narrative Attacks Are Now Business Risks

This isn’t about PR damage control—it’s existential. Narrative attacks can trigger real-world consequences: stock selloffs, customer panic, regulatory scrutiny. If you’re not monitoring information threats the way you monitor cyber threats, you’re leaving a backdoor wide open.

Satire is the New Trojan Horse

What starts as a meme can metastasize into mass disruption. The ambiguity of “just joking” content makes it harder to detect early and easier to defend after the fact. However, intent is irrelevant when outcomes are measurable. Don’t wait until humor turns hostile.

Cross-Partisan Narratives Travel Faster and Hit Harder

The #TheBanksAreOutOfMoney campaign didn’t belong to the left or the right—it fed into both. That’s the danger. When a narrative gets co-opted across ideological divides, amplification skyrockets, and fact-checking gets drowned out by tribal rage.

Automation Amplifies, but Real People Drive Panic

Bots helped boost the signal, but real people sharing screenshots, telling personal stories, and sounding alarms gave this campaign its legitimacy. Disinformation doesn’t need to be fake—it just needs to feel familiar, urgent, and “share-worthy.”

Resilience Requires Intelligence, Not Just Reaction

You can’t fight what you can’t see. Organizations must invest in narrative intelligence platforms that detect manipulation patterns, map network behaviors, and track real-time sentiment shifts. Reactive comms are no longer enough. The advantage goes to those who see the wave coming before it breaks.

Organizations, from banks to social platforms to media outlets, need to strengthen their defenses against cybersecurity threats and narrative attacks designed to exploit uncertainty. This includes proactive monitoring for coordinated behavior, rapid response strategies, and public education campaigns that help people better understand the dynamics of digital manipulation.

Financial institutions should be on high alert to stay ahead of fast-moving narratives. The modern “bank run” may not involve lines of customers; it could start and crescendo entirely online, in the space of hours. Recognizing the signals of narrative attacks early can distinguish between a manageable reputational hit and a full-blown crisis of confidence.

- To receive a complimentary copy of The Forrester External Threat Intelligence Landscape 2025 Report, visit here.

- To learn more about how Blackbird.AI can help you in these situations, book a demo.

Dan Patterson • Head of Corporate Communications

Dan Patterson is a strategic communications leader driving impact at the intersection of artificial intelligence, cybersecurity, and media. At Blackbird.AI, Dan leads communication and content strategy that breaks down complex AI and cybersecurity concepts for diverse business audiences. Prior, he was the national tech correspondent for CBS News.

Dan Patterson is a strategic communications leader driving impact at the intersection of artificial intelligence, cybersecurity, and media. At Blackbird.AI, Dan leads communication and content strategy that breaks down complex AI and cybersecurity concepts for diverse business audiences. Prior, he was the national tech correspondent for CBS News.

Need help protecting your organization?

Book a demo today to learn more about Blackbird.AI.