Misleading Narratives Rippled Across the Internet After Silicon Valley Bank’s Collapse

Social media activists shared clashing claims around the tech darling's failure.

Image: Dall-E 3

The demise of Silicon Valley Bank, once a tech industry darling, has sparked fierce debate and claims of political motivations from all sides. It ignited a political firestorm online, with activists and influencers across the ideological spectrum pushing divergent narratives about the bank’s downfall.

LEARN MORE: What Is A Narrative Attack?

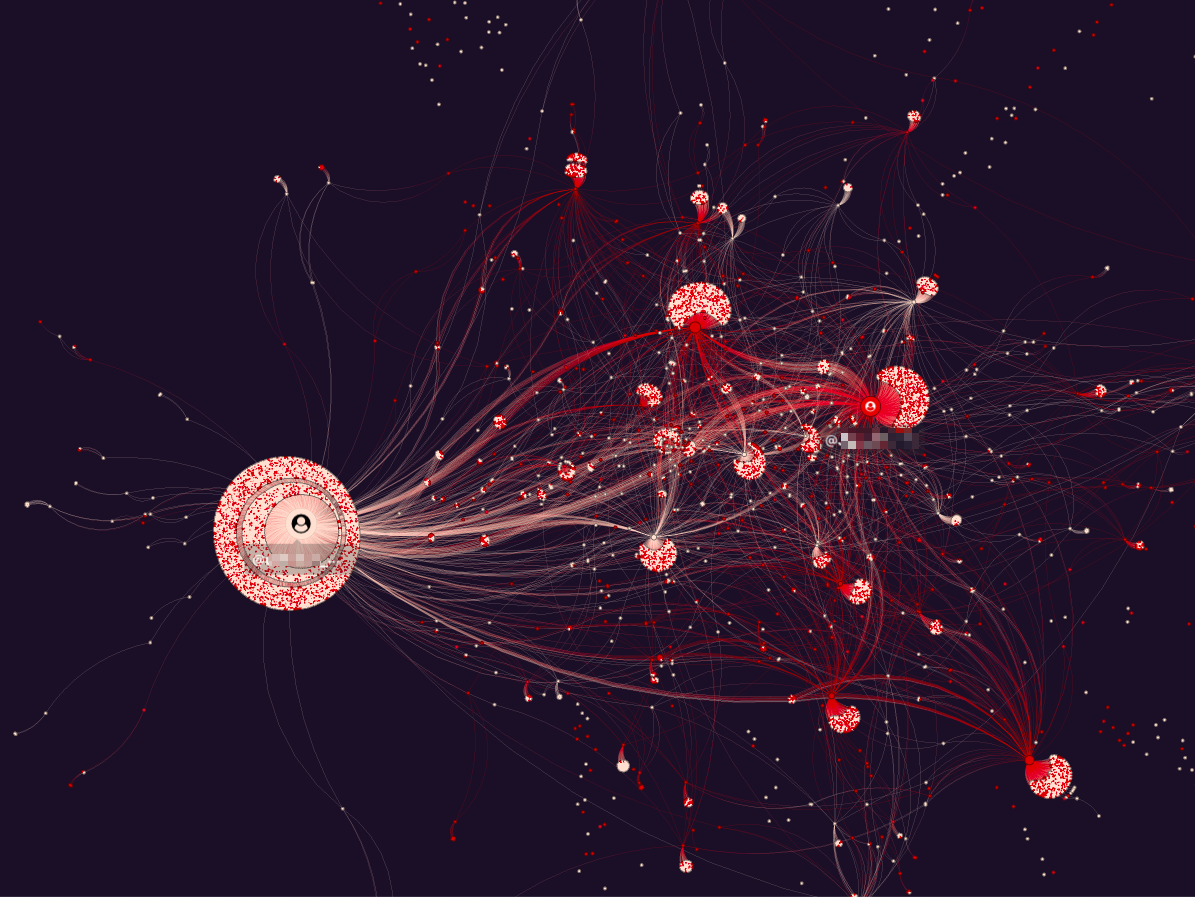

Analyzing the narratives around Silicon Valley Bank’s failure provided insight into how quickly misleading storylines can coalesce and propagate in today’s digital landscape. Blackbird.AI’s Constellation Narrative Intelligence Platform illuminated how even stalwart brands can have their reputations jeopardized when problematic narratives proliferate unchecked. Blackbird.AI closely monitored these online discussions to discover how stories form and quickly spread on the internet.

This visualization demonstrates a single user’s influence on a conspiratorial narrative. The users in red, representing members of the Right-Wing cohort, illustrate how narratives can resonate within particular communities online.

These are some of the most prominent misleading narratives surrounding the Silicon Valley Bank collapse.

Misleading Narrative: No Taxpayer Bailout of SVB

The collapse of Silicon Valley Bank spurred debates online on whether the government would or should bail out the bank with taxpayer money. While both sides of the American political spectrum expressed strong opposition to the notion of a “taxpayer bailout,” the fiercest opposition and anger (95.6% for the full narrative) came from the right-wing cohort (34.5% cohort participation). On March 10th, a Republican representative said he would not support a taxpayer bailout of Silicon Valley Bank, which yielded over 2.5K retweets and over 21K likes.

Misleading Narrative: The California Government had deep ties to SVB

On March 12th, users within the right-wing cohort (30.5% cohort participation) and conservative cohort (13% cohort participation) began sharing a right-wing blog criticizing the California Governor. The report generated 1,480 engagements, with the article’s headline alleging that Silicon Valley Bank has deep ties to California politicians. Another vocal critic and agenda-driven influencer echoed suspicions about what the Newsom family might’ve known ahead of the bank’s collapse. Similarly, on March 18th, a prominent social media account dedicated to tracking politicians’ financial activities said that Newsom lobbied the White House to bail out SVB while failing to disclose that “his private wineries had reportedly been the bank’s clients and he may have even had a personal account at the bank.”

Misleading Narrative: SVB CEO dumped personal stock before the bank’s collapse

On March 10th, several financial and cryptocurrency news aggregators and influencers began sharing the claim that the CEO of Silicon Valley Bank sold $3.5 million worth of SVB stock ahead of the bank’s collapse. Other posts also suggested that the CFO and CMO also sold significant amounts of stock, insinuating that they knew about the bank’s potential collapse and acted to personally benefit instead of protecting customers. This narrative generated engagement from both the right-wing (16.6% cohort participation) and the Left-Wing (13.1% cohort participation) cohorts, with Disgust (31.9% detected within the narrative) being the most prominent emotion displayed within posts.

Misleading Narrative: SVB went bankrupt because of donations to “woke” causes – #GoWokeGoBroke

On March 14th, an agenda-driven influencer claimed that Silicon Valley Bank “gave $73 million to Black Lives Matter and other related causes,” along with the hashtag “#GoWokeGoBroke.” Other users in the right-wing (27.5% cohort participation) and conservative (14.4% cohort participation) cohorts also shared this claim, insinuating that SVB’s connection to progressive activism was related to the bank’s collapse. The narrative was picked up by a prominent news network, which sourced the claim to a database from the conservative institute.

Narrative attacks now pose a significant threat to organizations that depend on customer trust and loyalty. In competitive sectors like banking and financial services, a high-profile incident can cause lasting damage to a brand’s reputation. The results can be disastrous, as it was for Silicon Valley Bank. For a robust and rapid response, companies need preemptive narrative strategies to inform better decisions across cybersecurity, PR, and marketing when crises emerge. AI narrative intelligence solutions like Blackbird.AI empower security, communications, and brand teams with analytics and recommendations to help safeguard corporate interests and consumer trust.

It’s important to note that a broad spectrum of issues contributed to Silicon Valley Bank’s collapse. Knowing about these narratives would not have prevented the crash. However, partners, customers, and other organizations in the bank’s ecosystem could have seen the narrative risks and made decisions faster using Blackbird.AI’s Constellation Narrative Intelligence Platform.

To learn more about how Blackbird.AI can help in these situations, contact us here.

Daniel Gonzalez • Solutions Engineer

Daniel is a Solutions Consultant for Blackbird.AI based in New York City, responsible for architecting creative solutions for clients and partners from Blackbird.AI’s suite of products. He speaks Spanish and was previously a Consultant within Deloitte’s Public Sector Counter-MDM practice.

Daniel is a Solutions Consultant for Blackbird.AI based in New York City, responsible for architecting creative solutions for clients and partners from Blackbird.AI’s suite of products. He speaks Spanish and was previously a Consultant within Deloitte’s Public Sector Counter-MDM practice.

Need help protecting your organization?

Book a demo today to learn more about Blackbird.AI.